What Every Homeowner Should Know About Their Equity

Curious about selling your home? Understanding how much equity you have is the first step to unlocking what you can afford when you move. And since home prices rose so much over the past few years, most people have much more equity than they may realize.

Here’s a deeper look at what you need to know if you’re ready to cash in on your investment and put your equity toward your next home.

Home Equity: What Is It and How Much Do You Have?

Home equity is the difference between how much your house is worth and how much you still owe on your mortgage. For example, if your house is worth $400,000 and you only owe $200,000 on your mortgage, your equity would be $200,000.

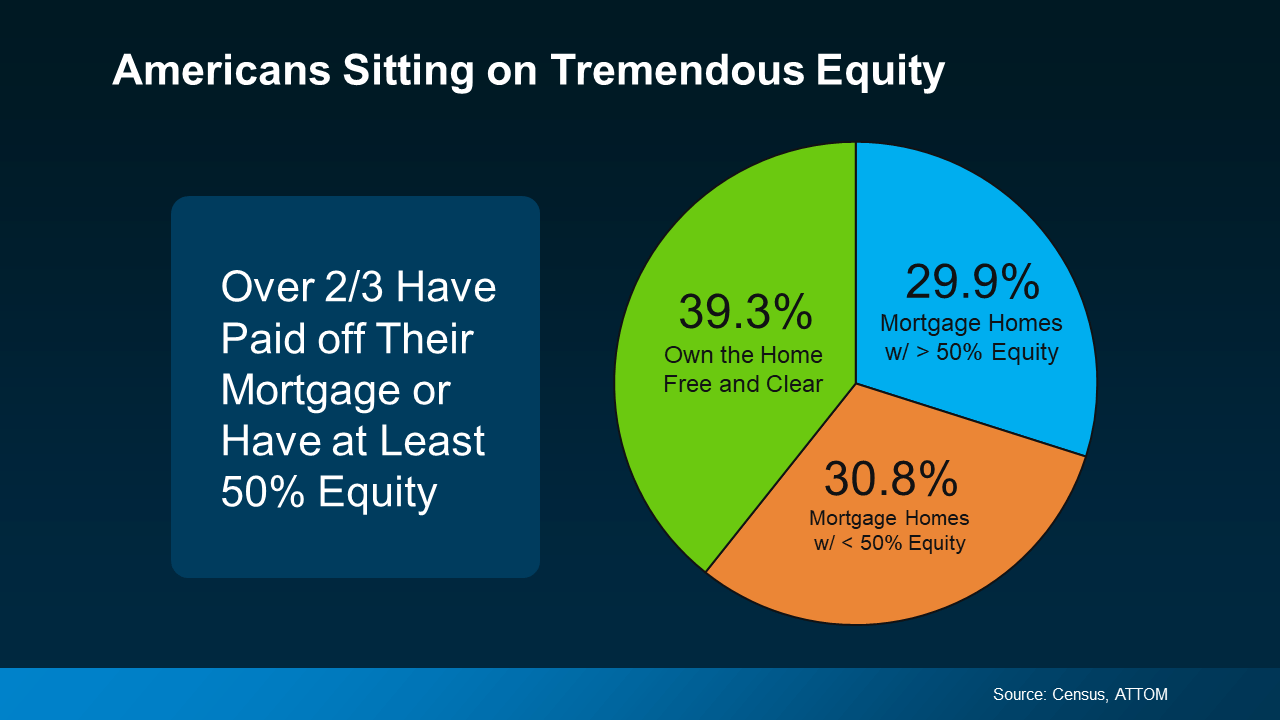

Recent data from the Census and ATTOM shows Americans have significant equity right now. In fact, more than two out of three homeowners have either completely paid off their mortgages (shown in green in the chart below) or have at least 50% equity in their homes (shown in blue in the chart below):

Today, more homeowners are getting a larger return on their homeownership investments when they sell. And if you have that much equity, it can be a powerful force to fuel your next move.

Today, more homeowners are getting a larger return on their homeownership investments when they sell. And if you have that much equity, it can be a powerful force to fuel your next move.

The Power of Equity

Significant home equity can provide several advantages:

- Profitable Sale: Selling your home can generate substantial proceeds, allowing you to purchase a new home, downsize, or invest.

- Debt Consolidation: Equity can be used to pay off high-interest debts, improving your financial situation.

- Home Improvements: Tap into your equity to fund home renovations or additions.

What You Should Do Next

If you’re thinking about selling your house, it’s important to know how much equity you have, as well as what that means for your home sale and your potential earnings. The best way to get a clear picture is to work with your agent, while also talking to a tax professional or financial advisor. A team of experts can help you understand your specific situation and guide you forward.

Calculating Your Home Equity

To accurately determine your home equity, consider the following:

- Current Market Value: Obtain a professional home valuation to assess your home's current worth.

- Mortgage Balance: Review your mortgage statement to determine the outstanding loan amount.

- Home Equity Line of Credit (HELOC): If you have a HELOC, subtract the outstanding balance from your equity.

Partner with a Local Expert

Selling your Iowa home requires expertise. As a trusted local real estate agent, I can help you assess your home's value, understand market conditions, and develop a strategic selling plan.

Let's Explore Your Options

If you're considering selling your Iowa home and unlocking your equity, I'm here to assist you. Contact me today for a no-obligation consultation to discuss your goals and explore your options.

Categories

Recent Posts

GET MORE INFORMATION